By David Brown, General Manager

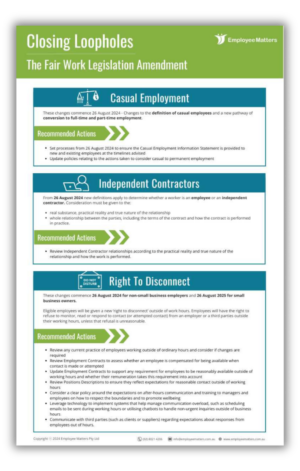

Cast your mind back to February this year and all the media reports around the Closing Loopholes (no. 2) Bill which included changes such as:

- The Right to Disconnect

- Changes to Casual Employment

- The New Definition of an Employee

- Changes to Independent Contractor Rules and Definitions

You may not have heard too much since then, but all of these changes are due to take effect from 26 August 2024.

(Note: for small businesses of less than 15 employees, some of these rules and timelines are slightly different).

Let’s take a look then at a brief summary of the changes you need to be aware of and ready for in August 2024.

The Right to Disconnect

This new rule allows employees to refuse to monitor and/or respond to any work-related contact outside of their normal working hours, e.g. calls, texts, messages and emails.

There are a number of exceptions to this rule, the most important being if such a refusal would be ‘unreasonable.’ As always, what is reasonable will be a matter for interpretation and we will see a clearer picture as cases make their way to the courts, but we already have indications of what will and will not be reasonable. For example:

- Is the employee compensated, e.g. an on-call allowance?

- Is the employee a senior manager, where it would be more reasonable to contact them out of hours?

- Is there a reasonable purpose behind the contact, e.g. an emergency or requesting that the employee change their next shift?

- Will the contact cause unreasonable disruption to the employee, taking into account their personal circumstances, e.g. if they have carer responsibilities?

Things to Think About

When considering how to manage your new obligations, think about the following:

- Do you need to change any policies or processes around, for example, out-of-hours work, flexible working or on-call policies?

- Can you use technology to schedule communications, e.g. delayed or scheduled send options in your email or messaging systems?

- Have you made your managers aware of the new rules?

Employee Matters is here to advise you on how best to manage this new right in your organisation. Book a free call now to learn how we can help you implement this and other recent changes.

Casual Employment

Everything old is new again, as the saying goes, and this is especially true in terms of definitions of who IS and who IS NOT a casual employee. The new definition of WHO IS a casual employee is essentially a step back in time to a few years ago, before the High Court rulings in the ‘Workpac Cases.’

For the last three years or so, organisations have been able to rely on the fact that if your contract clearly states someone is a casual employee, then the law will see them as a casual employee. From August 2024, we are going back to a similar definition to that existing pre-Workpac, which is that you must look at the entirety of the working relationship to determine if in fact an employee is casual or permanent, i.e. what is the practical reality of the arrangement around whether there is a firm advanced commitment to provide work?

So it's time to once again look at your relationships with your casuals and make a judgement on this.

There has also been a change in how an employee would claim they are permanent rather than casual. Currently, you as the employer are bound to ask the casual if they wish to consider converting to permanent. From August 2024, the employee will need to approach their employer to request they be reclassified. Should they do this, there are obligations on the employer to consider the request, limits on when they can refuse the request, and obligations to consult and make a written reply to the employee with their reasons for refusal.

Lastly, there are changes in employers’ obligations to issue the Casual Employee information Statement. Currently, this must be issued to a casual employee when they commence employment. This will now change with requirements to issue: at commencement; after six months; after 12 months and every 12 months thereafter (the rules are less stringent for small businesses).

Things to Think About

- Consider your working relationships with all casuals and make a judgement on whether they meet the (more vague) test of whether they are truly casual. Consider shift patterns, how far in advance you plan your rosters, the regularity of the work and, the ability of the employee to refuse a shift.

- Think about the process you would follow if an employee claims they are permanent. How will you handle this, how will you communicate with the employee and how will you respond?

- Have you prepared your administration process and systems to meet your obligation around providing the casual employment information statement more regularly?

Again Employee Matters would be happy to discuss this with you should you have any questions. You can call us now on (02) 8021 4206.

Independent Contractors

As with casuals, we are seeing a change back to a more wide-ranging definition of who is an independent contractor.

With the inclusion of a definition of an employee in the Fair Work Act for the first time, the definition of who is not an employee has to be made on the same basis, looking at “the real substance, practical reality and true nature of the relationship.” The courts will look at the contract as they have before, but the contract will no longer be the sole, or even primary, evidence as to whether someone is a contractor or an employee. The facts of the case may include, among other things:

- does the worker wear a company uniform?

- do they supply their own equipment?

- do they have more autonomy in terms of how the work is done?

- can they subcontract the work to someone else?

- does the employer have other people doing similar work who are classed as employees?

Opt Out

A new opt-out provision is included for high-earning contractors who may choose to opt out of this definition and class themselves as a contractor regardless of the circumstances above. Strangely, although the opt-out has been in place since February 2024, the definition of ‘high income’ does not come into force until 26 August 2024 and we have still not been told what that high Income threshold will be.

Note also that the contractor is allowed to give an employee notice to change their mind and decide they no longer wish to opt out of the definition.

Summary

There are more changes that have come in and more changes still to be enacted.

- Changes to unfair contract terms which will affect organisations using ‘Gig Workers’ for instance (from August 2024)

- Introduction of industrial manslaughter as a criminal offence (from 1 July 2024)

- Introduction of criminal offences around wage theft (from 1 January 2025)

The areas discussed above are issues you need to be planning for right now.

For more information on your new obligations, contact us now to request a consultation on what you need to do to remain compliant.

Your Guide

Access this concise Closing Loopholes Bill summary and guide detailing the proposed changes to the Fair Work Act, and the implications for employers.

Book a meeting with Employee Matters today to find the right kind of outsourced HR & Recruitment service for your organisation’s needs:

Employee Relations Legislation Changes Hub

There is a significant amount of mandatory Employment Relations legislative change that impacts you and every other business in Australia now. Our resource hub is designed to help you understand these wide-ranging changes.

3-STEP UPDATE PACK

Take the first step to be compliant. Our 3-Step Update Pack helps Australian business owners and HR professionals understand what these new ER legislation changes mean and what to do about them.

Step 1 - HR Insights

Step 2 - Custom Roadmap

Step 3 - Ongoing Support

Need HR/Recruitment Support?

Call (02) 8021 4206 or email info@employeematters.com.au to discuss your HR, Recruitment or ER Legislation challenges with an experienced member of the Employee Matters team.

Alternatively, you can book a free call by completing the adjacent form: