First of all the good news – As we know now, the government has extended the JobKeeper scheme through to March 2021, albeit on reduced rates and tiered payments.

Unfortunately, the amendments to the scheme which covers the extension to the payments scheme and the temporary amendments to the Fair Work Act is complex to say the least!

There are a few important changes to be aware of. Here’s what you need to know in summary and in addition, we have produced a JobKeeper Decision Tree to help you work through where your business sits in terms of the new rules.

Definitions

First of all let’s set some definitions so we can see who is entitled to do what:

- Eligible Employer – an employer who will continue to be eligible for and is receiving JobKeeper payments after 27 September 2020

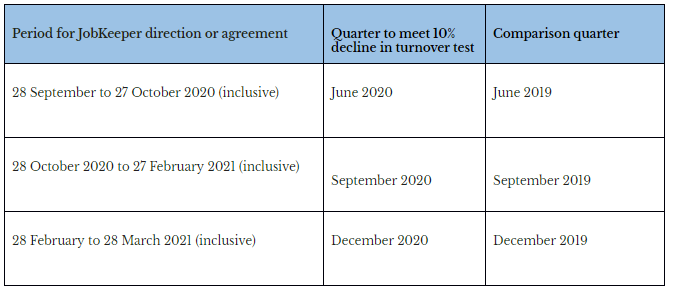

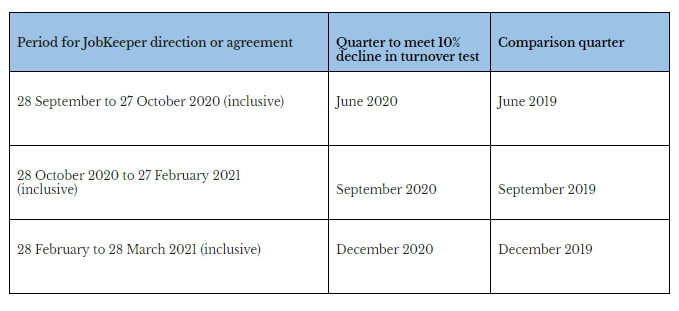

- Legacy Employer – an employer who was eligible for the first stage of the Job Keeper scheme but does not qualify from 28 September 2020. Under the new provisions they are able to continue utilising the temporary amendments to the Fair Work Act provided they can demonstrate at least a 10% decline in turnover for the previous quarter. This must be confirmed by an eligible financial service provider or for small businesses a statutory declaration. They must meet the following deadlines:

Extension to the Fair Work Act

The extended provisions allow eligible employers to continue to utilise the JobKeeper provisions to issue Job Keeper enabling stand downs and directions and make agreements with their employees to change their days or times of work.

As long as an employer continues to be eligible for the Job Keeper scheme after 27 September 2020, any Job Keeper enabled directions, or agreements to changes to days or time of work will remain lawful. JobKeeper enabling directions or agreements stop applying when they’re cancelled, withdrawn or replaced, or on 29 March 2021 (whichever comes first).

The only thing to be aware of is that if the Job Keeper enabled directions, or agreements you provided to your employees contain reference to a termination date of 27 September 2020, you will need to go through a process of reissuing the direction or agreement. This includes complying with the minimum 3 day consultation and notice requirements. click Here

IMPORTANT NOTE – From 28 September 2020 employers will not be able to utilise the original Job Keeper 1.0 provisions to make an agreement with their eligible employees to take annual leave (including at half pay). Employers and employees will need to revert back to the usual rules related to the requesting and taking of annual leave. Ensure you understand and follow the provisions outlined in an agreement or award.

Changes for Legacy Employers

The Job Keeper 2.0 extension contains a new and entirely separate provision which covers Legacy Employers. Legacy employers can only issue directions and make agreements with employees that they previously received JobKeeper payments for and there are some important restrictions for Legacy Employers to be aware of:

- Job Keeper Enabling Stand Down

After 27 September 2020, a Job Keeper enabling stand down direction can be issued to previously eligible employees as long as it doesn’t:

- result in an employee working less than 2 hours on a work day

- reduce a full-time or part-time employee’s hours of work to less than 60% of their ordinary hours as at 1 March 2020.

- JobKeeper Agreements to Change Days or Times of work

After 27 September 2020, Legacy Employers can make agreements with previously eligible employees to change days or times of work but the agreement cannot result in the employee working less than 2 hours per day.

- Consultation and Documentation

All Job Keeper enabling directions or agreements currently in place for Legacy Employers will cease on 27th September 2020.

Legacy Employers who wish to utilise temporary changes will need to execute new agreements or directions. This includes providing 7 days notice in writing to eligible employees and following enhanced consultation requirements.

Legacy Employers are also required to provide written notice to their employees (who are currently subject to an agreement or direction) as to whether the Job Keeper enabling direction or agreement will remain in place or cease and whether they have obtained a certificate or statutory declaration demonstrating they have at least a 10% decline in turnover for the relevant quarter. This must be done on or before the dates below

Click Here for your JobKeeper Eligibility Flowchart and book a free Discovery Session today to discuss how you can navigate these changes today

Disclaimer – The advice, information and resources provided by Employee Matters in this article with regard to the JobKeeper scheme and temporary Fair Work Act changes (and their subsequent extensions), is generic and not specific to any business. It is based on our interpretation as HR professionals as at the date this article is published. It does not override information from the ATO or any government organisations and does not constitute specific legal or accounting advice and should not be relied upon as such. Employee Matters will not assume any legal liability that arises from our advice, information provided or the use of our documentation.